As part of my portfolio restructuring I decided to close my position in Archer Daniels Midland (ADM). You can read more about the company here and here. Sell price €84.50 ($93). Total return of the investment in 2016 was an estimated 23% (20% capital gain + 3% annual dividends) and exceeded my expectations in this “boring” dividend aristocrat. (Real return was much higher as I increased the position when the pandemic started).

Reasons for sale:

- Overvalued on historical measures using various valuation metrics.

- Low dividend yield for my dividend portfolio-there are better opportunities available with higher yield and Dividend growth rates.

- Cyclical business experiencing tailwind driven by short/mid-term events (war and supply chain disruption)-as a result it could be near top of cycle as current events might be priced in.

- Portfolio concentration and I’m still long the agriculture sector with several positions.

As you can see the sale was a very personal decision and that there is nothing wrong with the company. ADM is a high quality company and a dividend aristocrat. I just believe that my total return will be better if I increase another existing position which has more upside potential over the next 5-10 years with less risk. Near term ADM might perform very well if the war keeps dragging on, inflation stays high and supply chain disruptions keep pushing commodity prices higher. However I see there also evolving risks such as higher costs reducing their margins, unwise capital allocation in terms of overpriced acquisitions to deploy the high cash inflows.

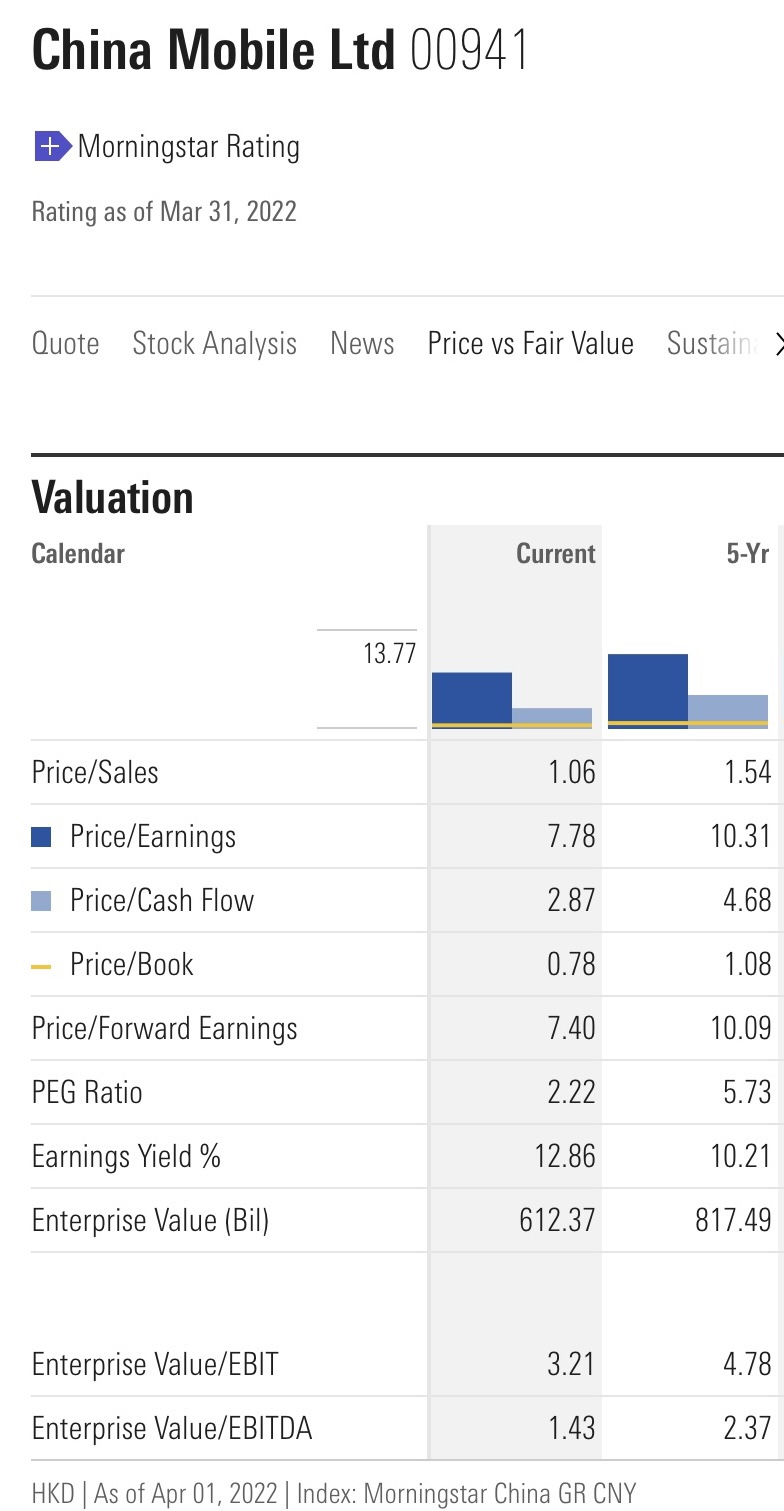

With the proceeds I increased my position in China Mobile (~HKD 55/€6.20) offering 7+% dividend yield. The company just increased their dividend by more than 20% and management stated they are planning on more returns for shareholders over the coming years. It’s an investment in EM but the second largest economy in the world and a defensive industry. The company has a strong cash position and generates an enormous amount of free cash flow. It’s also the largest mobile network company in the world by subscribers.

Here are some numbers from Morningstar: China Mobile seems cheap on historical measures and vs. industry.

I might increase this position further if the share price goes down a bit more. Thanks for reading.

I might increase this position further if the share price goes down a bit more. Thanks for reading.

Disclosure: Long China Mobile. No investment advice. Please do your own research.