Henkel is a German chemical company. It’s segmented into two business units: Consumer goods and adhesive technology with both generating approximately 50% of the companies revenue. Their portfolio consists of well-known brands: Persil, Loctite, Fa, Pritt, Dial, Purex, Schwarzkopf, SYOSS and many others. Iconic brands with history:

Henkel is a German chemical company. It’s segmented into two business units: Consumer goods and adhesive technology with both generating approximately 50% of the companies revenue. Their portfolio consists of well-known brands: Persil, Loctite, Fa, Pritt, Dial, Purex, Schwarzkopf, SYOSS and many others. Iconic brands with history:

- Persil: 1st commercially available laundry detergent that combined bleach with the detergent. In some countries licensed to Unilever.

- Pritt: Pritt invented the first glue stick (Pritt Stick).

- Dial: 1st antibacterial soap.

- Purex: One of the most widely used laundry detergent in North America

- Schwarzkopf: Hair cosmetics brand with history of more than 120 years

The company is family controlled but managed by external managers.

The share price had a good run until 2016/17 which faded after the departure of the growth focused CEO who moved to Adidas. The following CEO was a bit unlucky by judging his work solely on the share price. But in fact, ratio expansion came back to lower levels. Since 2020 Henkel has a new CEO Carsten Knobel (previously CFO) who also started buybacks. (The long-lasting share price decline after a CEO departure reminds me a bit of Fresenius where the CEO left to Nestle and his successor was busy structuring the business).

The adhesive business is cyclical with their dependence on the automobile sector.

I think the combination of a noncyclical business with a cyclical could generate great opportunities doing anticyclical acquisitions by using cash flows from the other business unit.

The company recently merged home care and beauty care into the consumer brands unit reducing complexity and giving some fantasy about a potential spin off (which I don’t believe happens considering the company’s history and ownership).

Henkel keeps growing organically and by doing acquisitions. There is some setback resulted by the Russian war having some write offs for a business they built over 30 years in the country. This business is mostly written off and management doesn’t see any additional costs arising and is currently in process of selling it.

Let’s look at the numbers:

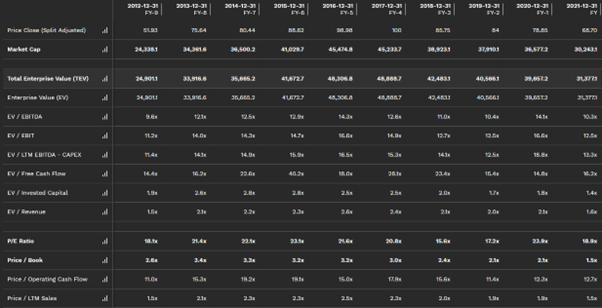

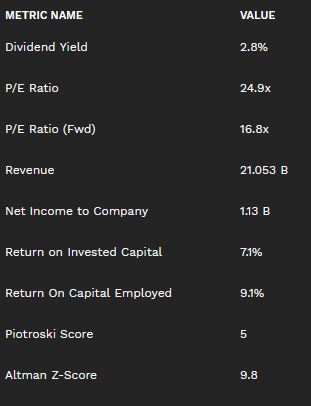

From a valuation perspective it trades near a 10-year multiple low indicating that its inexpensive. Dividend yield is at higher end from a historical point.

The balance sheet is rock solid and the company keeps reducing debt further which isn’t probably the most efficient way to allocate capital but definitely not bad in environment with rising interest rates.

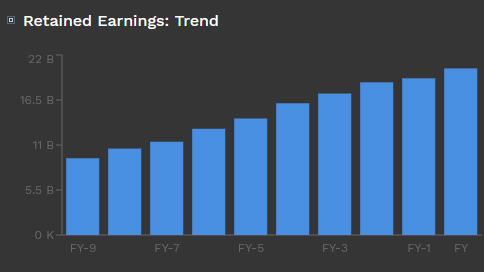

What I found interesting is that the retained earnings on the balance sheet keep growing and are now by around EUR 20b. Yes, almost 20b retained earnings for a 30b market cap company! Looks very big and about time to return a bit more to shareholders. Anyone has an opinion on that?

The company started a share buying back program last year of up to 1 billion euro running until end of this month. This is around 3.3% of market cap and it seems that management buying back wisely shares at a discount when comparing Henkel’s valuation over the years.

On my valuation model Henkel (67 Euro) appears to be undervalued by around 22% using a 10% discount rate with a terminal multiple of 20 which was typical for Henkel in the past.

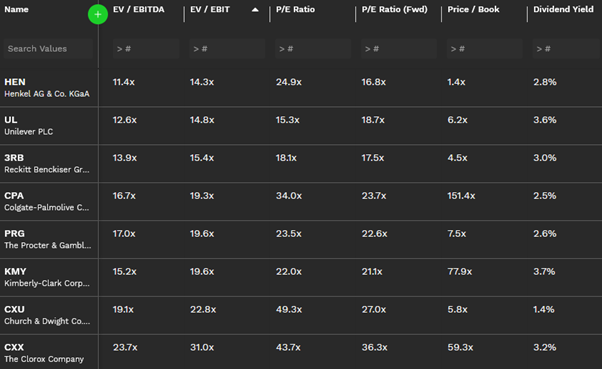

When comparing the company vs. peers in the consumer discretionary space then they appear as one of the cheapest on different valuation metrics. Reason might be their lower ROIC and having 50% of the business in a cyclical industry. The strong balance sheet is probably one of the reasons for the lower ROIC and I think the good financials offset that parts of the business is cyclical.

Q3 2022

The company reported double digit organic sales growth. Main driver was the adhesive business by growing 22.6% nominally. They raised their guidance for 2022 with 7-8% organic revenue growth, improved margins and better than expected earnings (lower decline). Reasons: higher material prices, restructuring expenses and investments (around 1.1 billion euro).

Q4/FY 2022

- Group sales: 22.4 billion euros, organic growth* of 8.8 percent

- Operating profit (EBIT): 2.3 billion euros, -13.7 percent

- EBIT margin: 10.4 percent, -3.0pp

- Earnings per preferred share (EPS)**: 3.90 euros, -17.8 percent at constant exchange rates

- Proposed dividend on prior-year level: 1.85 euros per preferred share

Outlook for fiscal 2023:

- Organic sales growth: 1.0 to 3.0 percent

- EBIT margin: 10.0 to 12.0 percent

- Earnings per preferred share (EPS): between -10.0 and +10.0 percent (at constant exchange rates)

The outlook is not really impressive. I have to admit that I was a bit disappointed with these figures. The company seems to have more difficulties with passing higher input costs on. The beauty care business is in decline because of divestments and discontinuation of non core activities. Growth of the laundry and home care unit was slowing in Q4. Main growth driver were the cyclical adhesive unit, north america and emerging markets. Earnings outlook indicates that management anticipates that the return to higher margins takes a bit longer.

Pro:

- Share buybacks.

- On historical measures and various valuation methods the company appears undervalued.

- Very solid balance sheet.

- Family controlled and stock-based compensations for management supports shareholder value creation.

- Strong brands and high margins.

- Companies business should be less impacted by inflation as consumer division would be able to pass on higher costs.

Cons:

- Half of the business is cyclical nature and depending on the car industry.

- Slowing growth with small decline in non cyclical beauty beauty business.

- Legal structure being KgAa – limited shareholder rights.

Conclusion: I have a small position in my dividend portfolio and a stock savings plan as the company seems undervalued and an attractive long term investment. Despite the cyclical character of parts of the business I believe the company is a defensive investment considering their strong balance sheet.

Henkel keeps growing slow and steady but still seems to be in consolidation. When margins return to previous levels we might see higher share prices. This could result in a total annual return of 10-15% over the next few years. The companies share buybacks gives some downside protection, signals management trust and might also lead as additional catalyst. However an investor has to consider that the beauty business is in decline and overall growth was slowing in Q4. Consolidation might take a bit longer than I anticipated especially since the current main growth driver is the cyclical unit which could shift if the economic environment changes.

PS: I found this article interesting highlighting the potential undervaluation of the preferred shares: https://seekingalpha.com/article/4507114-henkel-stock-once-in-a-lifetime-trading-opportunity

This post is no investment advise. Please do your own research. I’m no financial advisor. This content is just for entertainment purposes and I don’t take any liability for anything written here on this blog.