This is just a brief follow up on my ADM post a few years ago. With time and additional purchases, it grew to one of my largest positions and therefore I think it’s about time to review the position again.

ADM is a global agricultural company with a long-term strategy focusing on optimizing their portfolio, driving efficiency and expanding strategically.

Source: ADM Investor Presentation

They are growing with acquisitions which drives revenue but also their goodwill on the balance sheet.

Source: ADM Investor Presentation

The management aims a ROIC of 10% by 2024 – if reached then it’s a good investment but first they need to get there from currently 7.7% which was achieved over a period of 7 years from 2013 6.6%. this means they need to improve by 230 basis points within the next 3.5 years which seems very ambiguous considering their previous performance improvement.

The key figures:

Share Price 18.04.2021: USD 59.45

Market Cap: $ 33.2B

Enterprise Value: 43.6B

Price/Book: 1.66 > on higher end on historical measures

P/E 2020: 18.87 and Forward P/E: 15.55

Shiller P/E: 20.77 > above history but below market (S&P 500 Shiller P/E:37.06)

Price/Cash Flow: 18.2 > Low cash flow

EV/EBITDA: 13.64 > Pricey

Current Ratio: 1.5

Quick Ratio: 0.86

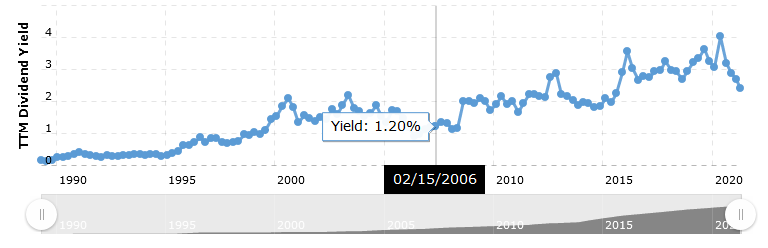

Dividend Yield: 2.44% (Payout 0.46); Dividend: USD 1.48; Dividend Yield on Cost (Purchase Jan. 2016): 4.7%

Dividend Growth 5 Years: 5.2% > above inflation

ROIC: 7.7% and WACC: 5.75 > shareholder value creation

Beta: 0.92 > lower volatility than market

ROE: 9.16

ROA: 3.83

Piotroski F-Score 5

Altman Z-score 2.89

Financial Strenght 5 of 10

Profitability Rank 6 of 10

Valuation on Gurufocus 5 of 10

Price Graham Number: 1.38 > implies overvaluation on a no growth basis.

Gordon Dividend Growth Model (Fair Value): USD 73.2

Discounted value based on EPS 21e 3.88 and discount rate of 10%: USD 64.45. Approximately 9% undervalued for an expected annual return of 10%.

Additional catalysts would be an increase in share buybacks and strong dividend increases supported by robust earnings growth. I don’t see another dividend increase this year following their pattern of one increase per year at the beginning of the year. ADM’s outstanding shares reduced by around 1.5% annually.

My current return for the purchase in 2016 is approximately 18% annually (15% capital return yearly plus 3% dividend).

Positives:

– It’s in a cyclical industry (commodity) but still defensive business model (consumer defensive).

– High quality company with long history.

– Tailwind for commodities which bottomed on their cyclical down trend in 2020 and the potential of inflation picking up.

– Dividend Aristocrat – Growing dividends for 45 consecutive years.

– Strong growth driver nutrition business.

– Open job positions suggest continuous organic growth anticipated by management.

– Experienced and diverse leadership team with proven track record.

– Global company (200 countries served) and therefore benefiting from growth in emerging markets.

– Lower valuation vs. S&P and Beta of 0.92 suggest a defensive character which can be useful in a richly valued market.

Negatives/Risks:

– Low Margin and capital intense business. Low free cash flow.

– Insider Sales are increasing and at a very high level. CEO compensation is not in line with earnings development and above average for companies of similar size.

– Fairly valued – with factor 10 on EPS discount model – Negative as I prefer undervalued companies which offer an expected annual return of more than 10% or an higher margin of safety. This means I wouldn’t buy it at today’s valuation.

– Slow growth.

– Low ROIC.

– Currently at higher end of valuation metrics on historical comparisons for P/E, Shiller P/E; Dividend Yield, EV/EBITDA; P/B.

Conclusion:

Hold (for now with tendency to reduce) > Let winners run.

– Quality company with good momentum.

– Cyclical commodity tailwind should support potential earnings surprises resulting in additional share price appreciation.

– Awaiting Q1 Earnings.

– Current share price offers an annual return of 7-10% for long term investors with a time horizon of 5-10 years.

Disclosure: I’m long ADM. No investment advice.

Recent Articles/Analysis:

https://seekingalpha.com/symbol/ADM

1 thought on “ADM – Archer Daniels Midlands update”