Today I’m writing about a company which I saw on my friends (emergingvalue.wixsite.com) watchlist. I recognised the name because adesso SE recently announced a cooperation with Asseco. So, there were two compelling factors – my friends EM knowledge and value approach and adesso SE a very successful company which benefits from the digitalisation trend (Disclosure Long adesso). I read Asseco’s latest report and had a look at their financials. Below I’m highlighting a few key points I found interesting. Their annual report included many graphs and since I like graphs, I couldn’t resist including a few in my post. You can also skip all and just scroll to the bottom to read my summary.

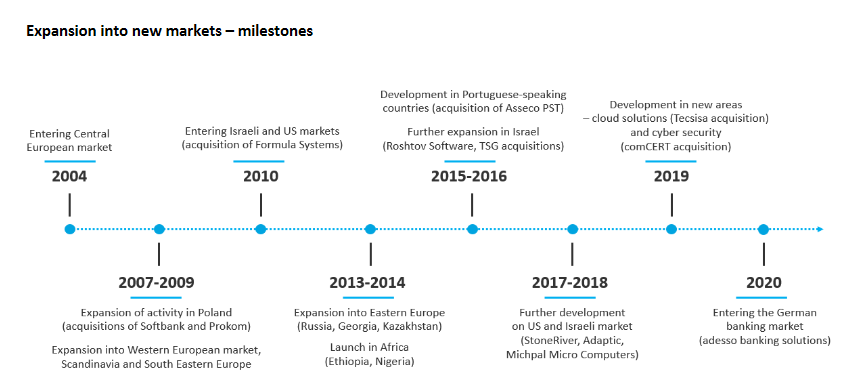

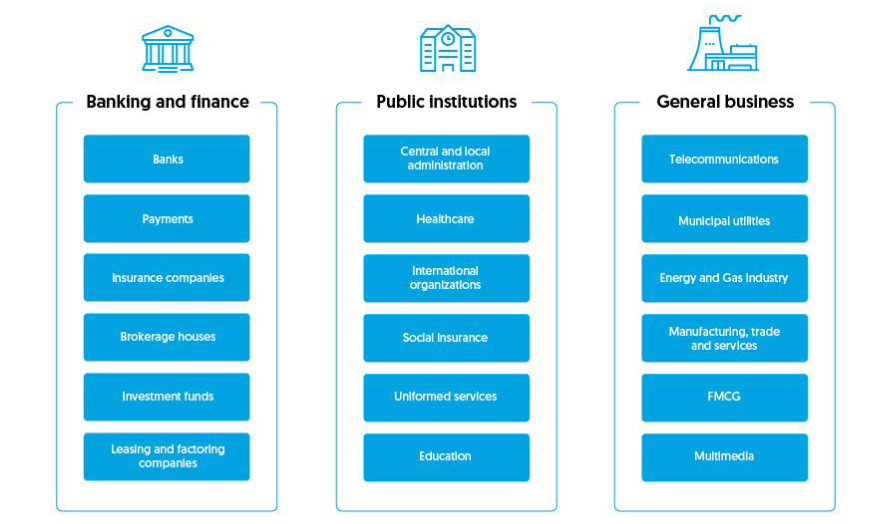

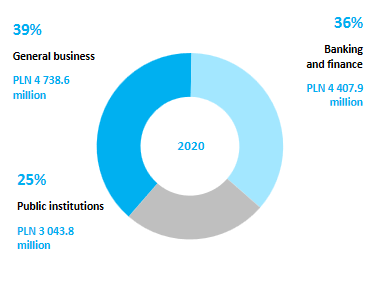

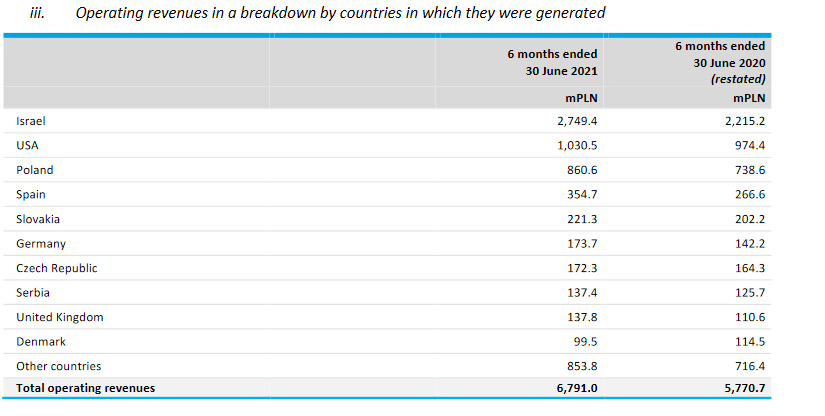

Asseco Poland S.A. was founded 1991 by Adam Goral (still CEO) and was one of the first start-ups in Poland. It is a software company which provides various services to financial industry, public sector and others such as telecommunication, energy, utilities.

Their Mission and vision

The mission of Asseco Poland and the Asseco Group is to improve the quality of life by providing solutions for people and technologies for business.

The strategy of Asseco Poland is focused on building long-term value for its stakeholders. It is based on two key pillars:

development of proprietary software and services and increasing the scale of operations through acquisitions.

- Organic growth

- Development through acquisitions

Positives:

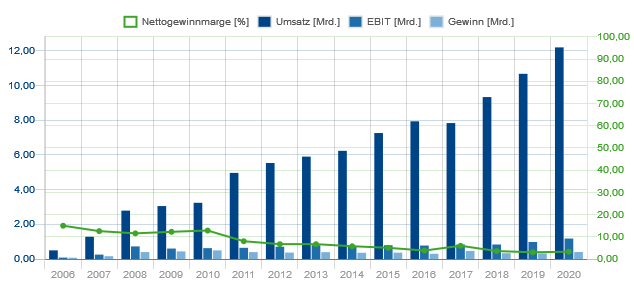

Tailwind due to massive demand for digitalisation. The company managed to grow revenue even during the GFC and Covid pandemic.

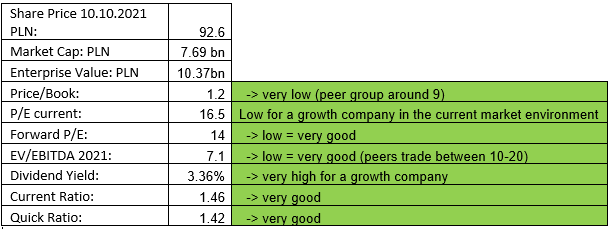

High dividend yield for a growth company.

One of the leading software manufacturers in Europe.

Owner led business (CEO holds 9.74% of shares outstanding).

Cash position higher than debt.

Low valuation and low EV/EBITDA.

Margin of safety of 3% to current share price using a discount rate of 15%.

Negatives/Risks:

There is not much I found…

Ops cash flow lower 2020 vs. 2019 (Covid year).

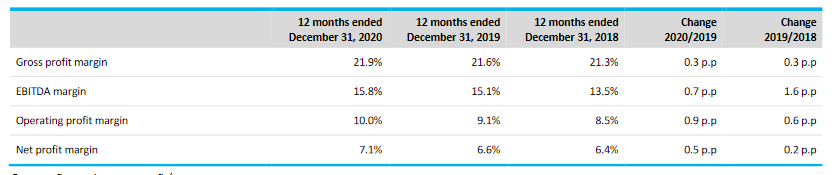

Over the last 15 years revenue was growing faster than profit > Shrinking margins.

Conclusion: Asseco S.A. is a quality company which is growing steadily. There isn’t much not to like about the company. The business model serves clients which need many years of investments to move their digitalisation strategy forward. The valuation is compelling vs. peers and while waiting for a revaluation by the market you get a juicy dividend from a growing company. Their share price went even up over the last weeks while the overall market was a bit bumpy and went down. My valuation model gives me an expected annual return of around 15% over the next 5-10 years. I put the company on my watchlist and might initiate a starting position.

Sources: Most graphs are from Asseco S.A. financial reports: https://inwestor.asseco.com/en/reports/financial-reports/2021/

What are their main products in software and how they are especially good?

Revenue Split with services?

They provide a huge variety of products and solutions. Their largest clients are banks…they are globally number 2 software supplier for the insurance industry…number 3 software supplier for public sector in CEE. I can’t judge their software from a customer standpoint but margins and success suggests that their products are good. Here are more information about what they do: https://asseco.com/files/public/uploads/Asseco_company_profile_2020_EN.pdf

Not sure what you mean with revenue split services? Breakdown revenue by each product?

Services is when they help customers install or use software made by another company: for example, Asseco helps companyB to move their data to Amazonwebservices or Azure.

so its mostly asseco own software?

Breakdown in products is published with proprietary software + services(79%), hardware + infrastructure (14%) and third-party software + services (7%).

Hi

Good article on an interesting company, indeed. Just had a look at their website. As I’ve seen, they have been also paying out dividends for some years. But a couple of years, when they paid out more than 100 % of their profits. I mean looking at their growth ambitions that’s an interesting one. They could obviously invest more into their business, strengthening their economic moat further and grow faster. Would be interesting to read your take on that aspect.

Cheers

Hi SavyFox,

Thanks for commenting. That’s a good point with the deteriorating dividend payout ratio over the years and something to keep an eye on as a dividend investor. I will include this in my next analysis. When you look at their consolidated financials then the payout isn’t above 100% (most subsidies are fully owned by them but something to investigate further).

When looking at their cash flow statement I can see that they are investing in acquisitions + R&D and these investments are growing (as a number) over the years.

Personally, I prefer companies which pay back a part of their profits to their shareholders with either buybacks or as dividends and not solely invest into growth at any price. That’s why I prefer buying shares of companies like Berkshire over Tesla. This minimizes my risk as an investor, but it is just a personal decision because I find it very difficult to evaluate growth associated uncertainties.