The Berentzen Group is a beverages company based in Germany. Segments are Spirits, Non-Alcoholic Beverages and Fresh Juice Systems. They develop, produce and market beverages from spirits to mineral waters and soft drinks and fruit presses for fresh-pressed orange juice. With well-known brands like Berentzen, Puschkin, Strothmann, Bommerlunder Doornkaat, Mio Mio and Citrocasa, the Berentzen Group is present in more than 60 countries across the world. Recently they acquired Goldkelchen, an Austrian premium cider brand.

The companies headquarter includes various historical buildings which are also used for events and attracts 35,000 visitors a year. This unit is hit strongest by Covid but contributes little to the company’s performance however it is good for marketing to promote the brand and engage within the community.

Major markets are Germany, Austria and Turkey.

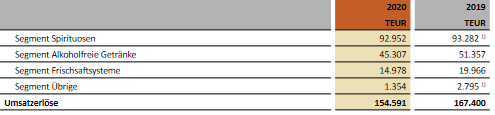

Revenue by region:

The business has been impacted by covid due to lockdowns, pub closures and event cancellations which interrupted their quality growth but this should be only temporary.

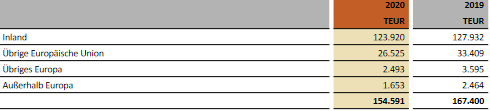

The key ratios:

Share Price 28.04.2021: EUR 6.00

Market Cap: EUR 56.73 Mio

Enterprise Value: € 41.3 Mio

Price/Book: 1.17

P/E 2020: 46 and Forward P/E: 22.6

Price/Cash Flow: 8.7

Shiller P/E: (S&P 500 Shiller P/E:37.06)

EV/EBITDA 3.20 very low, industry average 15.

EV/EBIT 6.50

Current Ratio: 1.12

Quick Ratio: 0.63

Dividend Yield: 2.3% (Payout 99%); Dividend: € 0.13/share

Dividend Growth 5 Years: 0 – Growth until pandemic from EUR 0.2 to 0.28 (2015-2019)

ROIC: 16.5 % and WACC: estimated 6.5. – Using ROIC 2019 as 2020 was exceptional due to pandemic (2020 ROIC= 9% > still above WACC)

Beta: 0.34 vs. DAX

Gurufocus:

Piotroski F-Score 5

Altman Z-score 1.74

Financial Strength 6 of 10

Profitability Rank 5 of 10

Valuation: 8 of 10

Price Graham Number: 1.85

Valuation estimations on various models:

- Gordon Dividend Growth Model (Fair Value): € 9.71/share.

- EV/EBITDA valuation: € 7.67/share – on historical measures and fair value in comparation to peers € 11.33/ share.

- Discounted value based on FCF 2020 (8.3 Mio), mixed scenario growth 1-5% next 5 years slowing down to 3% after and discount rate of 10%: € 12.2/Share.

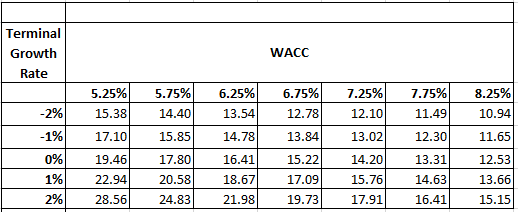

- Below valuation matrix assuming CF 3% CAGR over next 5 years with various WACC and terminal growth rate options:

Positives:

- Significantly undervalued on various valuation methods offering massive margin of safety with discounts of up to 50%.

- Some strong brands like growth driver Mio Mio.

- Growing nationally (Mio Mio expansion south Germany).

- International expansion with Goldkehlchen acquisition. Expansion into cider market seems to be a smart move as it is expected that the global market will grow by 3-6% annually (above beverage industry) and the CEO expects an double digit growth for Goldkelchen.

- Very established brands and company with 250 years history.

- Margins remained constant despite revenue decline.

- Managed to generate positive cash flow during pandemic despite massive hit in industry. Management delivered above market expectations.

- Good cash position.

- Very cheap vs. peer group.

- Strong ROIC indicates the company creates good shareholder value.

Negatives/Risks:

- No revenue growth over past years.

- Exposure to Turkey but less than 2% of total revenue and country should be at bottom of economic cycle.

- EBITDA margins (17%) suggest lower moat/pricing power as peers like Diageo (35%) Ko (38%).

- No indication that management owns shares. Shares don’t seem to be part of management compensation – I prefer companies where the leadership team has skin in the game.

Conclusion:

- On the first sight it looks like the company is a value trap with shrinking business but diving deeper it seems that they managed to turnaround the business despite the massive cash outflow to Aurelius as part of the restructuring. Berentzen had the tendency to disappoint the market until the new CEO came into office in 2017. Profitability is improving and so is cash. Management acted quickly during the pandemic by preserving cash, reducing costs leading to a positive cash flow. This allowed the company to reward shareholders with a small dividend while expanding their business internationally.

- There is a massive upside if company manages to grow.

- Mio Mio and Goldkelchen cider expansion could support growth for the coming years.

- Short term recovery of Turkey and return to normal from the pandemic are additional drivers.

Disclosure: I’m long Berentzen. No investment advice. Do your own research.

Additional info: CEO interview 23.04.21 (in German) https://www.nebenwerte-magazin.com/general-standard-berentzen-vorstand-im-interview-wenn-es-in-deutschland-soweit-ist-werden-wir-da-sein/

Hi

Interesting read on a company I‘ve been invested in for a couple of years. Berentzen is not so well known in the investor community but it really has been a solid player in my portfolio. I agree, at first sight looks like a value trap, terrible long time chart. But from time to time you have the possibility to enter into a position for a very attractive price.

Cheers

Hi,

Thanks for the interesting idea

I have been looking at the company and I have a couple of comments:

– Cash position at year end seems overstated by the impact of the spirit tax liability and the high level of sales in November/December. I think this deserves some adjustment to the EV.

– Why such a high level of D&A (EUR7-8m) is there any fixed asset/intangiblel in run-off?

– The company invest EUR6-8m of capex per annum. How much of that capex is related to growth and how much to maintain the existing asset base. Given the poor track record on growth this looks like defensive capex to me.

– What do you think is a normalize level of FCF generation? EBITDA levels and margins seem OK and thus the attractive EV/EBITDA. However, it terms of FCF Berentzen doesnt look so cheap and hence the low dividend.

Hi Ringo,

Many thanks for sharing your thoughts.

– Cash position: That’s a very good observation. EV ratios would be impacted indeed and lower the discount to my estimated fair value. I think on historical comparison it wouldn’t change much though. I haven’t looked at the whole industry but can imagine that on a peer comparison it might not have much impact since seasonality should impact most more or less.

– D&A: My understanding is that they had a € 1 Mio impairment for the termination of the cooperation between Pepsi and Vivaris which also impacted revenue. Contract was low margin bottling.

– Capex: Management reacted very quickly in 2020 and reduced investments due to Covid which I think was the right think to do because none knew in 2020 what will happen. Now in 2022 we might see after-effects which will impact profitability. Management spoke last week that there is cost pressure and their profit forecast was a bit disappointing.

– Normalised FCF: Fair point – there isn’t much discount.

My initial thought using Berentzen as a re-opening play has vanished in thin air after their latest earnings forecast. I still think downside is limited but upside could be big if one or two of their many marketing initiatives turn into a success story. There were many changes in marketing positions, bringing experienced people on board. If this monetarises, we could see some nice growth. I would say that after 2022 I find out if this paid off or if my money is better invested somewhere else.

Do you have any companies in the industry you prefer over Berentzen? I love Heineken for their excellence in capital allocation, and I read some articles about Ambra S.A. (nice write up from emergingvalue) which looks very interesting and seems to be a better compounder than Berentzen. What holds me back it is the current situation in Ukraine which could last longer and should impact the polish market too.

Thanks for the reply and interesting comments.

Don’t get me wrong, I like the Berentzen idea, especially from a valuation point of view and their reporting is excellent for such a small company.

However, with my limited knowledge of the company/sector, there are a few things that I dislike:

• This seems more capital intensive than what I expected: 40% of EBITDA is regularly spent into capex, one of the highest in my portfolio. However, growth has not been achieved in the past and dividends payments are unattractive. RoCE is quite high, but I am not sure if they are reinvesting at this rate (and probably the large D&A makes it optically more attractive).

• The company makes an extensive use of factoring. I don’t understand EUR1.0m of recurrent financial expenses with a significant net cash position that does not generate any income.

• Similar with the large pension liability of c.EUR9m which also limiting FCF generation.

All in all, this does not seem a great capital allocation to me. Hopefully in a more normalized environment post-covid they are willing to sort out these issues.

I am not a big expert in the sector, just look at companies that seem attractive (I am quite focused on valuations and low FCF/EBITDA multiples: recently bought Dole Plc and Ibersol in Portugal).

I also read on Ambra which seems an attractive one and indeed with a better track record (although at a higher price). I would like to review Anadolu Efes which looks like a great business in a depressed environment.

– Very interesting observations. Usually, I don’t dive so deep into financials. Could the higher CAPEX be used to lower taxes?

– Dole – I was a big fan of Total produce but never managed to pull the trigger. Recently I bought For Farmers (Dutch company) – seems super cheap but next earnings (tomorrow) can be bad depending on how they could pass on high energy prices.

– Ibersol – Strong brands there – looks interesting.

– Anadolu Efes: Good one – Last week I saw an interview with Marc Faber talking about Turkey and read a post on how Turkish businesses managed to navigate through so many crises. This would be one of the few companies I would bet on Turkey, but I have no knowledge about the market.

What is used to lower taxes is the D&A which in this case higher than capex as the company has lower fixed assets year after year.

ForFarmers looks like a very attractive idea, I like this type of companies in the current environment. They might suffer from inflation in the next couple of quarters but long term their demand is stable and I am sure they have the ability to increase prices. Do you have an investment thesis on that one?

Let me know if you want to have a deeper look at Ibersol, I have analyzed it quite in detail.

Thanks for the explanation.

ForFarmers: Nothing written yet…Pro’s: Valuation, Out of fashion/boring industry, not ESG compliant(therefore overlooked, not included or exited by some funds), Growing(doing acquisitions here and there), High dividend yield, some buybacks, food industry seemed more defensive in an overall booming stock market, I have many oil stocks – currently energy seems at a later stage of it’s cycle – so when Oil goes down and I miss the exit then at least FF should do well 🙂

Ibersol: I’m always enjoying reading analyst reports – that’s how I can learn. Do you have a blog?